The Future of Marine Fuels

BUNKERING CHALLENGES FOR LPG, METHANOL AND ETHANOL

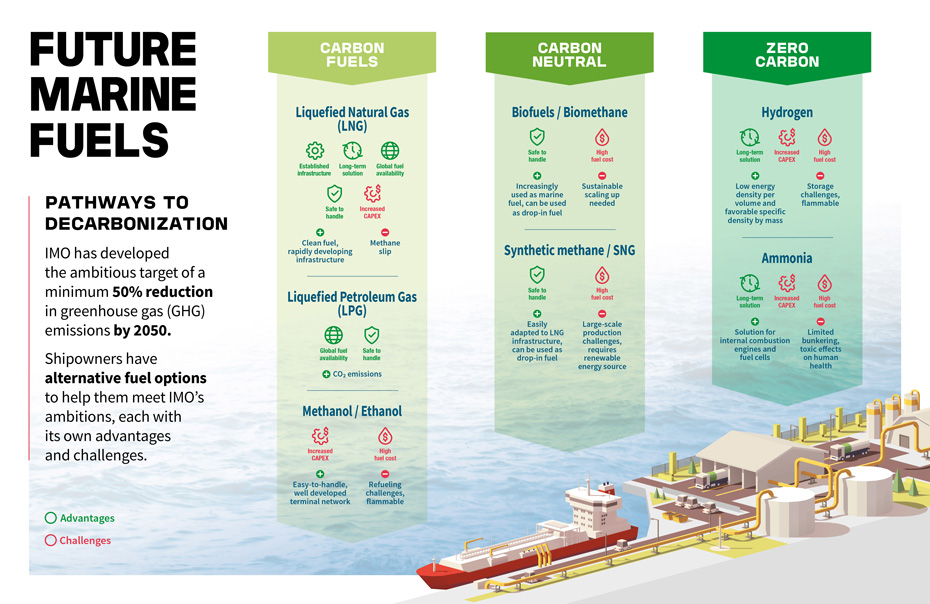

Liquefied petroleum gas (LPG) is a possible alternative to LNG. LPG is both widely available and easy to handle and store, leading to lower CAPEX than with LNG. Still, LPG presents a familiar problem: although it limits carbon output, it does not eliminate CO2 emissions, and while LPG terminals are operational worldwide, bunkering infrastructure is notably lacking. However, although current levels of LPG production are insufficient to make this alternative fuel a catch-all solution for shipping, it will certainly be part of the larger solution, starting with LPG carriers.

Methanol and ethanol present other alternatives to LNG, with similar profiles to LPG. As drop-in fuels, they are easy to handle compared to LNG, and benefit from a well-developed global terminal network. At the same time, bunkering facilities are limited, and methanol- and ethanol-fueled ships need to be designed and operated with special care, given the gases’ toxic and flammable nature. To use them safely, additional CAPEX is required for storage and handling. While the CAPEX gap is smaller than for LNG, fuel costs are less favorable when compared with LNG and LPG.

MOVING TOWARDS CARBON NEUTRALITY: BIOFUELS AND SYNTHETIC METHANE/SNG

Biofuels are a carbon-neutral solution becoming increasingly available as marine fuel. Major maritime players have been testing them in response to growing social pressure to reduce shipping CO2 emissions. However, mass-scale production of biofuels is not sustainable, particularly since other industries already use biofuels. This leaves them in much the same position as LPG: a good partial solution, but not a panacea.

Synthetic methane/substitute natural gas (SNG) and bio-methane are another set of attractive options, as they are compatible with current LNG propulsion technologies. In theory, SNG and bio-methane can be carbon-neutral alternatives when used in tandem with carbon capture and fuel cell technology, and existing LNG fuel infrastructure can be easily repurposed to source both. However, making SNG carbon neutral depends on the availability of renewable energy, and production remains costly in the short term.

A CARBON-FREE FUTURE WITH HYDROGEN AND AMMONIA

Further down the line in the world of clean fuels are hydrogen and ammonia. Intrinsically carbon free, these fuels produce zero CO2 emissions when sourced renewably, and both are clean fuel solutions for internal combustion engines and fuel cells. It is to be noted than both fuels have a much lower energy density than traditional fuel oils; this needs to be accounted for in ship design and will impact costs. While hydrogen has a favorable specific energy (about 3x higher than that of fuel oil) its energy density is 4-8 times lower, depending on the hydrogen’s state. Ammonia, on the other hand weighs twice as much as fuel oil, but requires “only” three times the space to contain the same amount of energy

The long-term, long-distance onboard storage of liquid or compressed hydrogen remains a technical challenge that will be expensive to solve in the short term. So, despite the possible applications of pressurized or liquid hydrogen for transport, ammonia – which acts as a hydrogen carrier – currently shows greater promise as a zero-carbon fuel for shipping.

For ammonia, the processes for storage and transport are well established. Moreover, it is one of the most widely used chemicals in the world, with global production levels of around 190 million tons per year. It is therefore widely available, although marine bunkering infrastructure would need to be developed. In addition, safety issues associated with ammonia’s toxicity and caustic properties, which create the need for careful storage and handling, are to be addressed – ultimately through regulation.

The change is called IMO 2020. The intent of the regulation is to provide environmental and health benefits for ports and nearby coastal areas by progressively decreasing emissions produced by heavy bunker fuels, referred to by the IMO as “Sulphur Oxides (SOx) and particulate matter (PM).”

Link & Copyright: https://marine-offshore.bureauveritas.com/insight/future-marine-fuels-pathways-decarbonization

What Happened Lately? Sulphur Cap Regulations

Sulphur Cap Regulations: IMO 2020 at a Glance

The change is called IMO 2020. The intent of the regulation is to provide environmental and health benefits for ports and nearby coastal areas by progressively decreasing emissions produced by heavy bunker fuels, referred to by the IMO as “Sulphur Oxides (SOx) and particulate matter (PM).”

By the 1st of January 2020, the International Maritime Organization (IMO) imposed a sulphur cap of 0.5 % in marine fuel oil. The substantial sulphur reduction from 3.5% m/m to 0.5% m/m applies for ships operating outside emission control areas (ECA). In ECAs like the Baltic Sea, North Sea, and US Caribbean Sea, the limit of 0.10% is already in effect with the use of marine distillates and ULSFO (Ultra Low Sulphur Fuel Oil).

Will IMO 2020 regulations affect oil prices? How will Owners and Charterers respond? Here’s some future prospects and to find out more with the examined market data figures.

Impact of compliance on fuel markets and refiners

IMO 2020’s changes to the bunker fuel market can potentially affect fuel oil markets overall. High-sulfur bunker demand currently makes up almost 50 percent of total global residual fuel oil demand. And global bunker demand is 70 percent HSFO, 28 percent diesel or MGO, and 2 percent other fuels (such as LNG, gasoline, or kerosene).

Shifting bunker fuel demand from HSFO to a combination of VLSFO and MGO will increase overall oil demand in the short term while severely cutting demand for HSFO. In turn, increased MGO or VLSFO demand by shipowners will increase crude runs by 250,000 barrels per day. As a result, all regions will experience higher refinery utilization, pushing markets to simpler marginal configurations and higher margins in 2020. Cracking margins across regions will see a boost in 2020 due to increased growth in distillate demand. And more complex refining processes, such as coking, will see an even higher jump.

Briefly on IMO 2020 Low Sulphur Alternatives

The sulphur regulations drive the transition towards low-sulphur fuels, alternative fuels and scrubbers. Here are the most popular alternatives:

- Very Low Sulphur Fuel Oil (VLSF) covers the new range of blended products with a maximum of 0.5% sulphur, which makes it an IMO compliant fuel outside ECAs.

- Ultra-Low Sulphur Fuel Oil (ULSF) contains a maximum of 0.1% sulphur and is primarily used by ships working in ECAs.

- Scrubbers are exhaust gas cleaning systems that can be installed in order to allow shipowners to continue burning HSFO, while remaining compliant with IMO 2020.